The China Fintech Patent Database is a comprehensive database covering patents related to the fintech field within China. Developed by CnOpenData based on a fintech patent lexicon (containing 78 underlying technology keywords and application scenario classifications) and a multidimensional classification framework of the "ABCD+" technology system (Artificial Intelligence, Blockchain, Cloud Computing, Big Data, Internet Technology, Security Technology), this database ensures strict data collection processes to guarantee patent validity, ownership information, and technical detail accuracy. By interfacing with national-level patent databases, it tracks the full lifecycle of patents from application, examination to authorization, including core fields such as legal status changes, rights transfers, and citation relationships.

Data Features:

- Complete Data Fields: Provides full identifiers including patent application numbers (专利申请号), publication numbers (公开号), authorization numbers (授权号), and priority numbers (优先权号). Comprehensively records key fields such as legal status (法律状态), patent type (专利类型; invention/utility model/design), number of claims (权利要求数), and cited literature (引用文献), establishing patent stability evaluation dimensions.

- Data Cleaning Process: Deduplication through multidimensional identifiers such as application numbers and publication numbers. Eliminates obvious erroneous data and filters outliers.

- Authoritative Verification Mechanism: Cross-validates critical fields using multi-source data to ensure accuracy. Provides unique patent identifiers (专利唯一识别符) for third-party comparison and verification, establishing a cross-validation mechanism.

Potential Application Scenarios:

- Academic Research: Tracks the penetration process of AI technologies in finance (e.g., the migration of machine learning from risk control to smart investment research) using patent time-series data. Identifies the origin and diffusion paths of disruptive technologies (e.g., federated learning) through patent citation networks. Constructs a "Patent-Paper-Policy" tridimensional correlation model to reveal industry-academia-research collaborative innovation patterns. Quantifies the practical contributions of university patents to the fintech industry.

- Commercial Services: Evaluates technological moats through patent layout density (e.g., the quantity and quality of patents in intelligent customer service for specific banks). Identifies core technical barriers of global industry leaders using patent family data. Screens high-potential investment targets based on patent value evaluation models. Predicts market breakout periods for emerging technology tracks to assist VC/PE deployment.

Through the above design, the CnOpenData China Fintech Patent Application and Authorization Database provides complete data support for fintech patent research—from technical insights to commercial implementation—combining academic rigor with practical utility for business decision-making.

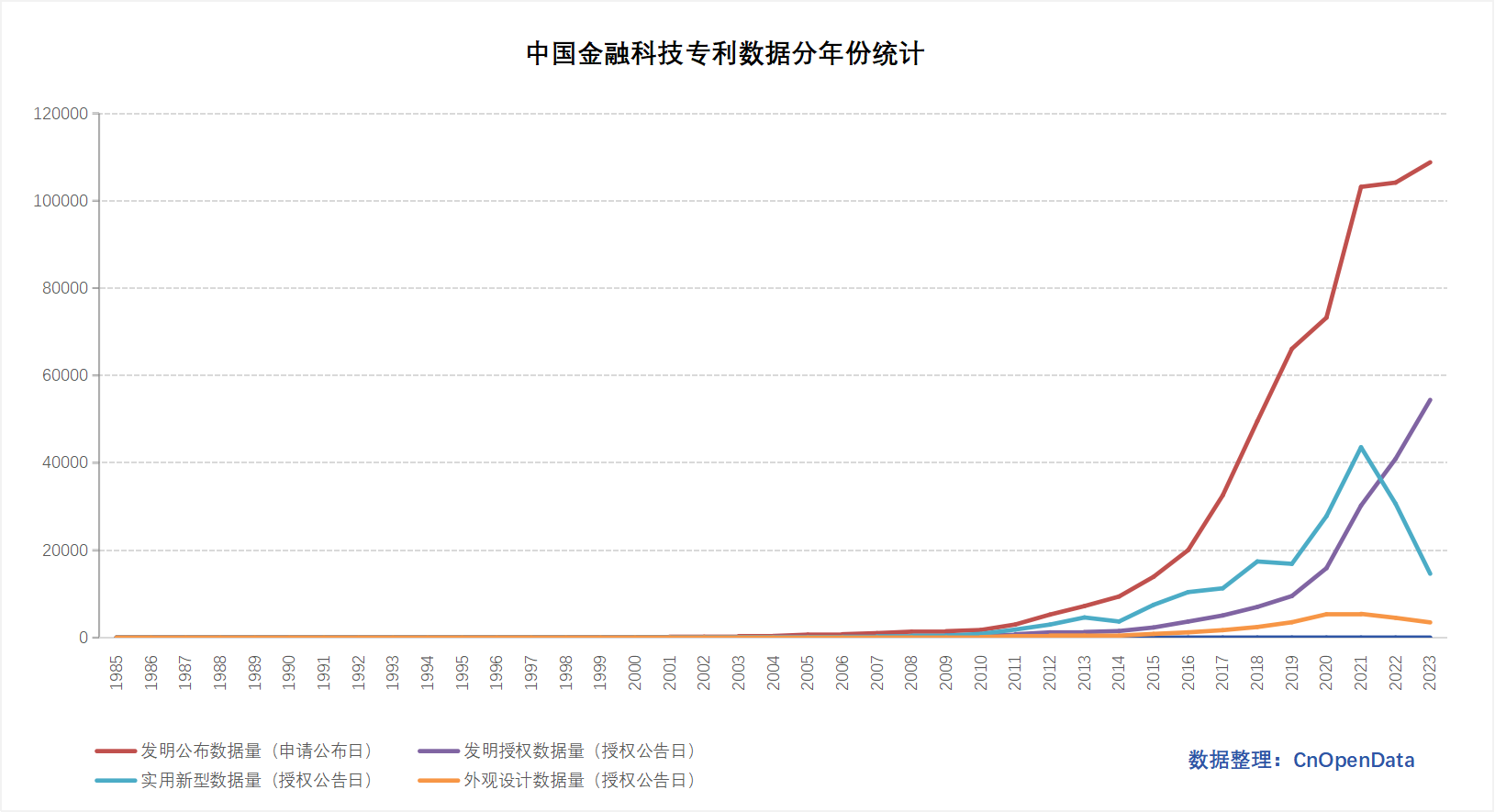

Time Range

- Invention publications (发明公布) are counted by application publication date: 1985-2024

- Invention authorizations (发明授权)/utility models (实用新型)/design patents (外观设计) are counted by authorization publication date: 1985-2024

Data Scale

Field Display

Sample Data

Basic Information Table of Chinese Fintech Invention Publication Patents

Basic Information Table of Chinese Fintech Invention Authorization Patents

Basic Information Table of Chinese Fintech Utility Model Patents

Basic Information Table of Chinese Fintech Design Patents

Chinese Fintech Patent Transaction Table

Data Update Frequency

Annual updates