Professor Fuwei Jiang and his research team published the groundbreaking study "Media Text Sentiment and Stock Return Prediction" in China Economic Quarterly (Issue 4, 2021), introducing an innovative research achievement in finance—the Chinese Financial Sentiment Dictionary.

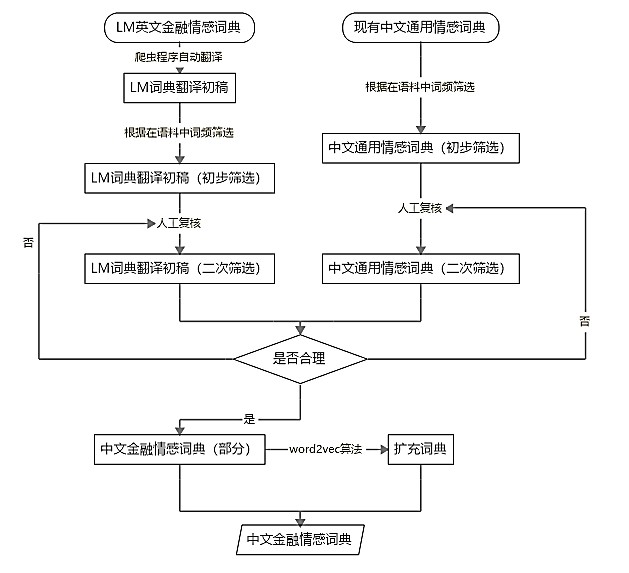

"Based on the Loughran and McDonald (2011) dictionary, this study constructs a more updated and comprehensive Chinese financial sentiment dictionary through manual screening and word2vec algorithm expansion. Using this sentiment dictionary to calculate textual sentiment indicators from Chinese financial media, we find that media sentiment can more accurately measure changes in investor sentiment in China's stock market and exhibits significant in-sample and out-of-sample predictive power for stock returns. Media sentiment also demonstrates notable predictive capabilities for key macroeconomic indicators, holding substantial academic and practical value."

—"Media Text Sentiment and Stock Return Prediction"

In accordance with the creators' intentions and while respecting intellectual property rights, readers may freely use this dictionary with proper citation to the following works:

- Fuwei Jiang, Joshua Lee, Xiumin Martin, and Guofu Zhou. “Manager Sentiment and Stock Returns.” Journal of Financial Economics 132(1), 2019, 126-149.

- Fuwei Jiang, Lingchao Meng, and Guohao Tang. “Media Text Sentiment and Stock Return Prediction.” China Economic Quarterly, no. 04, 2021, pp. 1323-1344.

Authorized by the creators, CnOpenData has established a dedicated data showcase and index for this dictionary to facilitate academic access.

To download the data, please redirect to Chinese Financial Sentiment Dictionary (github.com, requires VPN) or download directly at the bottom of this page. For more details, refer to "Media Text Sentiment and Stock Return Prediction".

Data Construction Methodology

Sample Data

References

- Fuwei Jiang, Joshua Lee, Xiumin Martin, and Guofu Zhou. “Manager Sentiment and Stock Returns.” Journal of Financial Economics 132(1), 2019, 126-149.

- Fuwei Jiang, Lingchao Meng, and Guohao Tang. “Media Text Sentiment and Stock Return Prediction.” China Economic Quarterly, no. 04, 2021, pp. 1323-1344.

Data Update Frequency (数据更新频率)

Updated irregularly (不定期更新)