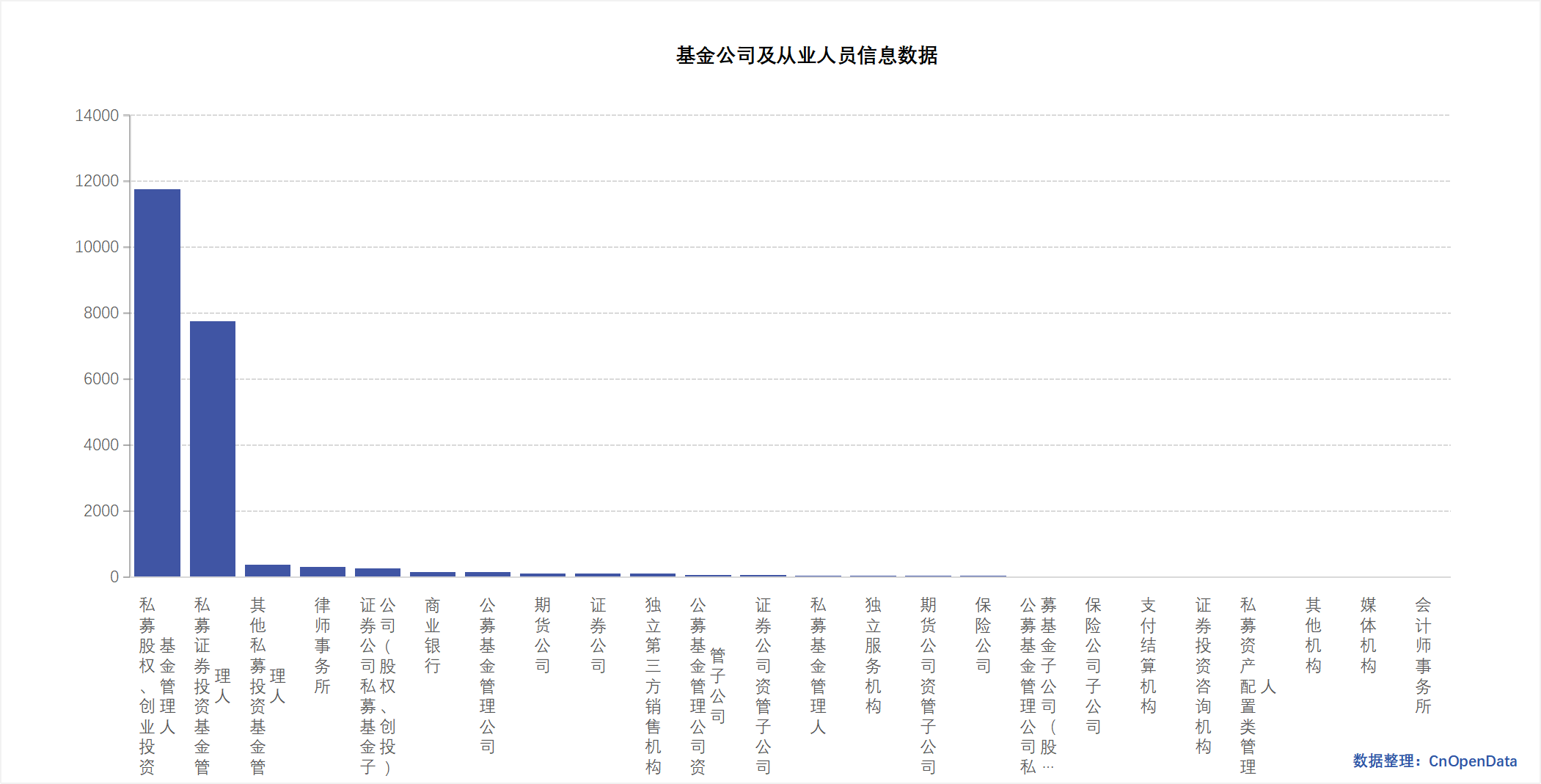

The Fund Companies and Practitioners Information Database systematically integrates fundamental information, qualifications, and career transition records of China's public fund companies and their practitioners. It covers dimensions such as company/institution names, organization types, employee counts, business qualifications, as well as key personnel fields including educational backgrounds, certificate statuses, acquisition/expiration dates, and career history changes. This dataset undergoes systematic compilation and standardized processing based on publicly available information sources, comprehensively reflecting the structural characteristics and dynamic evolution of enterprises and talent within the fund industry. It supports diverse application scenarios including financial talent research, institutional compliance analysis, industry regulatory policy evaluation, and human resources decision-making, providing a robust data foundation for understanding China's fund industry ecosystem.

Data Uniqueness:

- Integration of Organization-Individual Linkages with Dynamic Trajectories: While providing fundamental profiles of fund companies, it meticulously documents practitioners' qualification statuses and career transitions, enabling multi-level analysis from micro-individual to macro-organization perspectives.

- Inclusion of Integrity and Status Change Records: Captures certificate status changes and integrity records of personnel, offering unique dimensions for studying industry credit systems and professional conduct.

Data Application Value:

- Academic Research: Supports empirical studies in financial talent mobility, career development pathways, and certification effectiveness.

- Institutional and Industry Analysis: Facilitates evaluation of fund companies' human capital structures, team stability, and compliance/risk management capabilities.

- Policy and Regulatory Studies: Assists regulators in comprehending industry talent landscapes, formulating talent policies, and refining qualification management systems.

- Human Resources and Headhunting Services: Provides data support for corporate recruitment, background verification, and market competitiveness analysis.

The CnOpenData Fund Companies and Practitioners Information Database organically integrates corporate fundamental information, personnel qualifications, and career transition data. It offers researchers, institutional decision-makers, and regulatory bodies a comprehensive, reliable, and highly structured data resource, particularly suited for in-depth analysis of financial talent and organizational behavior. The database features scientific design and extensive coverage, demonstrating significant academic value and practical application potential.

Time Coverage

As of August 30, 2025

Data Scale

Field Display

Sample Data

Fund Company Basic Information Table

Fund Company Practitioner Basic Information Table

Fund Company Practitioner Career Transition Table

Relevant Literature

- Kuchler T, Li Y, Peng L, et al, 2022, "Social proximity to capital: Implications for investors and firms", The Review of Financial Studies.

Data Update Frequency

Annual updates