Since the reform and opening-up, China's insurance industry has experienced rapid growth, playing a significant role in compensating disaster losses, maintaining social stability, and supporting national economic development. The industry's remarkable progress manifests in three dimensions:

- Rapid expansion of insurance institutions: The number of Chinese insurance companies surged from 1 in 1980 to over 200.

- Substantial growth in premium income: National premium income increased from 460 million yuan in 1980 to 4.49 trillion yuan in 2021, demonstrating exponential growth over four decades.

- Accelerated asset accumulation: By 2021, total assets in China's insurance sector reached 24.8874 trillion yuan, representing an 11.5% year-on-year growth and maintaining robust asset expansion.

To standardize the domestic insurance market, the China Insurance Regulatory Commission (CIRC) centrally designs and issues insurance licenses with national unified codes. These legally binding licenses, bearing CIRC's official seal, authorize insurance holding companies, insurance groups, insurers, asset management companies, brokerage firms, and loss assessment agencies to operate. Subsidiaries of insurance holding companies/groups not engaged in core insurance businesses are exempt from license requirements.

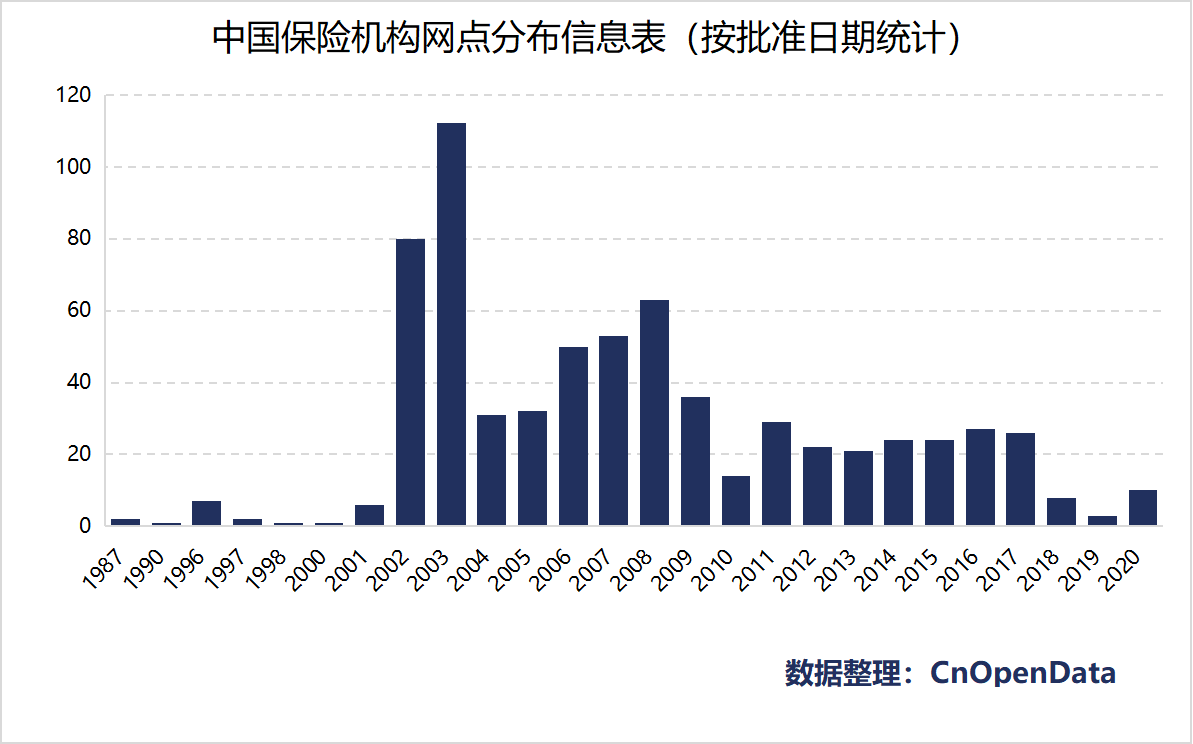

The CnOpenData Complete Dataset of Insurance Institution Branches comprehensively documents branch distribution, operational anomalies, and market exits, including fields such as institution name(机构名称), license code(编码), business scope(业务范围), and pre/post-change address information(变更前后地址信息). This dataset provides reliable support for research on China's insurance institutions.

Time Coverage

Cut-off date: 2020.05

Data Scale

Field Display

Sample Data

Distribution Information Table of Chinese Insurance Institution Branches

Anomaly Records Table of Chinese Insurance Institution Branches

Market Exit Records Table of Chinese Insurance Institution Branches

Update Frequency

Annual Update