This database system encompasses full-chain information on nationwide land transactions since 2000, covering four core transaction types: land supply outcomes, leases, mortgages, and transfers. Data are systematically collected from authoritative public sources, comprehensively documenting dimensions including land location, area, land use (土地用途), price, ownership, development constraints (e.g., floor area ratio), and temporal milestones. It provides infrastructure-level foundational support for research on China's land resource allocation, urban development trajectories, and macroeconomic trends.

Data Uniqueness

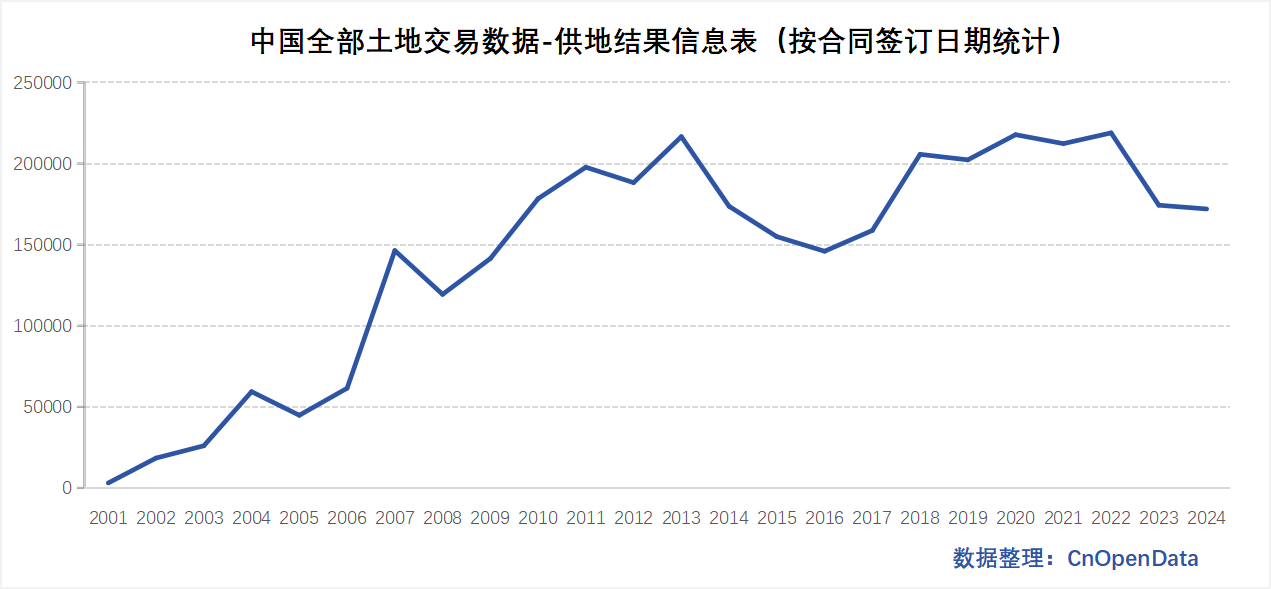

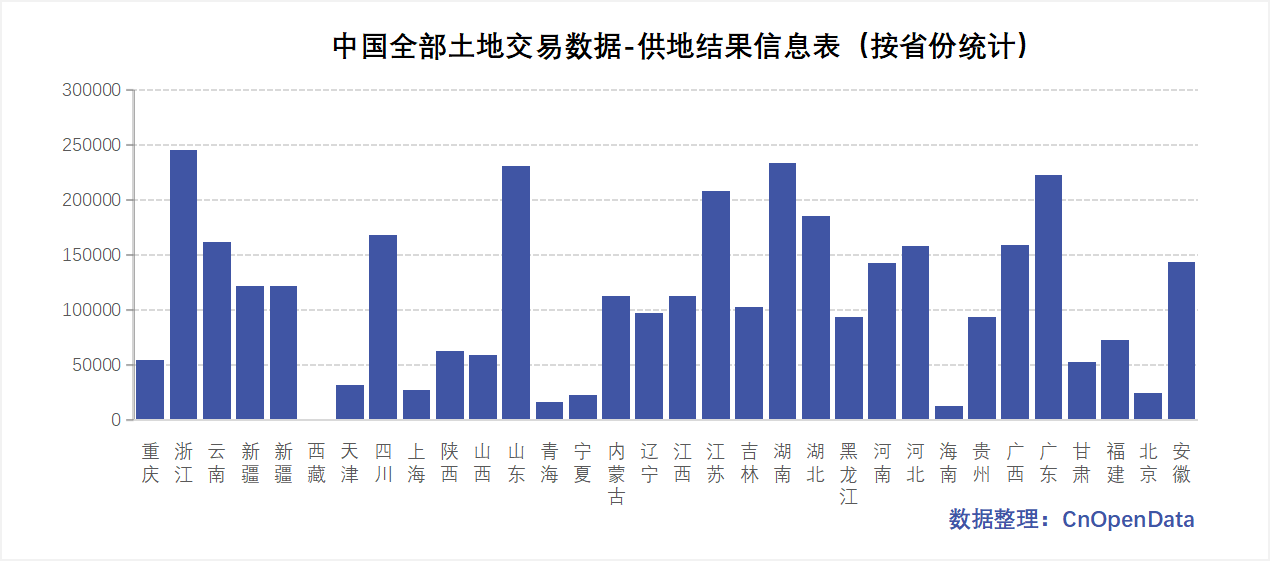

- Extended Temporal Coverage and Nationwide Scope: Spans land transaction records across China since 2000, enabling the tracking of historical market evolution and policy impacts over two decades.

- Panoramic Integration of Land Transaction Chains: Incorporates four core transaction forms—land supply, leasing, mortgaging, and transfer—to holistically characterize the land market.

- Comprehensive Field Structure and Fine-grained Data: Single tables contain dozens of fields, such as land use (土地用途), floor area ratio (容积率), greening ratio (绿化率), building density (建筑密度), height restrictions (限高), transaction price (成交价), and mortgage amount (抵押金额), facilitating granular analysis.

Data Application Value

- Land Policy and Urban Development Analysis: Quantitatively evaluates institutional changes in land governance over 24 years, revealing structural shifts in land utilization and the intrinsic logic of urban expansion, thereby supporting territorial spatial planning decisions.

- Land Finance and Financial Risk Assessment: Analyzes local fiscal dependencies and land-hoarding behaviors by real estate enterprises, monitors mortgage risks, and provides evidence for macroeconomic security and real estate market regulation.

- Decision Support for Governmental and Corporate Land Resource Management: Enhances governmental land supply efficiency, optimizes land reserves and development intensity for real estate firms, and supports collateral valuation for financial institutions.

The CnOpenData China Comprehensive Land Transaction Database offers core advantages of full-cycle coverage, multi-type integration, and high granularity, enabling one-stop consolidation of land transaction chains. Whether researching the evolution of China's land system, urban spatial restructuring, assessing regional economic resilience, or corporate strategic planning by real estate enterprises, this repository serves as an irreplaceable foundational data infrastructure. We are committed to advancing academic innovation and commercial insights in land-related fields through systematic data engineering capabilities.

Data Scale

Temporal Coverage

- Land Supply Results - Basic Information Table: 2000-2024

- Land Supply Results - Installment Payment Agreement Information Table: 2000-2024

- Land Lease Table: 2000-2019

- Land Mortgage Table: 2000-2019

- Land Transfer Table: 2000-2019

Field Display

Sample Data

Land Supply Results - Basic Information Table

Land Supply Results - Installment Payment Agreement Information Table

Land Lease Table

Land Mortgage Table

Land Transfer Table

Related Literature

- Li Yongyou & Zhang Zhenzhen, 2024: "Land Revenue Logic of Municipal Governments' County-to-District Conversion," Management World, Vol. 12.

- Lü Yue, Zhang Haotian & Xie Hongjun, 2024: "Land Investment Attraction, Incentive Distortions, and Strategic Corporate Innovation: Evidence from Industrial Land Transfers," The Journal of Quantitative & Technical Economics, Vol. 8.

- Li Weibing & Yang Yongwen, 2024: "Environmental Regulation Reform and Local Governments' Strategic Land Supply Behavior," The Journal of World Economy, Vol. 9.

- Zhang Yan, Zhao Lingxue & Liu Qing, 2024: "Factor Prices and the Construction of a New Development Paradigm: Evidence from Industrial Land Prices and Firms' Domestic-International Market Choices," The Journal of Quantitative & Technical Economics, Vol. 5.

- Yan Haosheng, Wang Jianfei & Sun Jiuwen, 2023: "How Does Collective Construction Land Marketization Affect State-Owned Land Markets?—New Evidence Based on Machine Learning," The Journal of Quantitative & Technical Economics, Vol. 6.

- Yang Ligao, Han Feng & Zeng Yi, 2022: "How Does Land Resource Allocation Affect Urban Economic Development Quality?—Spatial Econometric Analysis Based on Land Market Transaction Prices and Urban Panel Data," Journal of Management Sciences in China, Vol. 7.

- Fan Ziying, Cheng Kewei & Feng Chen, 2022: "Land Price Regulation and Corporate R&D Innovation: Evidence from Group Identification," Management World, Vol. 8.

- Zhang Kai, Shen Ji, Xu Hongming & Zhang Qinghua, 2021: "Spillover Effects and Urban Commercial Land Development Strategies: Research Based on Transaction Methods," Economic Research Journal, Vol. 1.

Data Update Frequency

Land Supply Results - Basic Information Table and Installment Payment Agreement Information Table are updated annually.

Land Lease Table, Land Mortgage Table, and Land Transfer Table are not updated.