Article 12 of China's Measures for the Administration of Stock Exchanges stipulates that stock exchanges shall implement self-regulatory measures or disciplinary actions against violations in accordance with their articles of association, agreements, and business rules, thereby fulfilling their self-regulatory management responsibilities.

This database comprehensively collects regulatory measures information issued by the Shanghai Stock Exchange (SSE) and Shenzhen Stock Exchange (SZSE) to A-share listed companies and related entities since 2013, covering core fields such as security code(证券代码), regulatory type(监管类型), case details(处理事由), involved parties(涉及对象), action date(处理日期), and document name(文件名). It also provides original text links and PDF files for each regulatory measure, offering authoritative foundational data for researching China's capital market regulatory dynamics, corporate compliance behaviors, and risk early-warning mechanisms.

Data Uniqueness

- Full-market Coverage with Dual-table Structure: Integrates regulatory information from both SSE and SZSE, overcoming limitations of single-exchange data and facilitating cross-exchange comparative analysis.

- Original Regulatory Document Support: Includes original text links and PDF files, enabling direct access to unstructured details like enforcement bases and violation specifics, complementing structured data.

Application Value

- Academic Research: Analysis of correlations between regulatory penalties and corporate behaviors (e.g., governance deficiencies, financial fraud warnings), policy effectiveness evaluation (e.g., impact of inquiry letter systems on information disclosure quality).

- Commercial Decision-making: Supports financial institutions in incorporating regulatory penalty records as compliance risk indicators for ESG rating models.

Rooted in authoritative public sources, this database features a unique dual-table structure, long-term coverage, and document traceability. Through systematic organization and multidimensional supplementation, it provides academia and industry with comprehensive A-share regulatory data resources, serving as a vital tool for studying China's capital market supervision mechanisms, corporate compliance management, and investment risk prevention.

Time Coverage

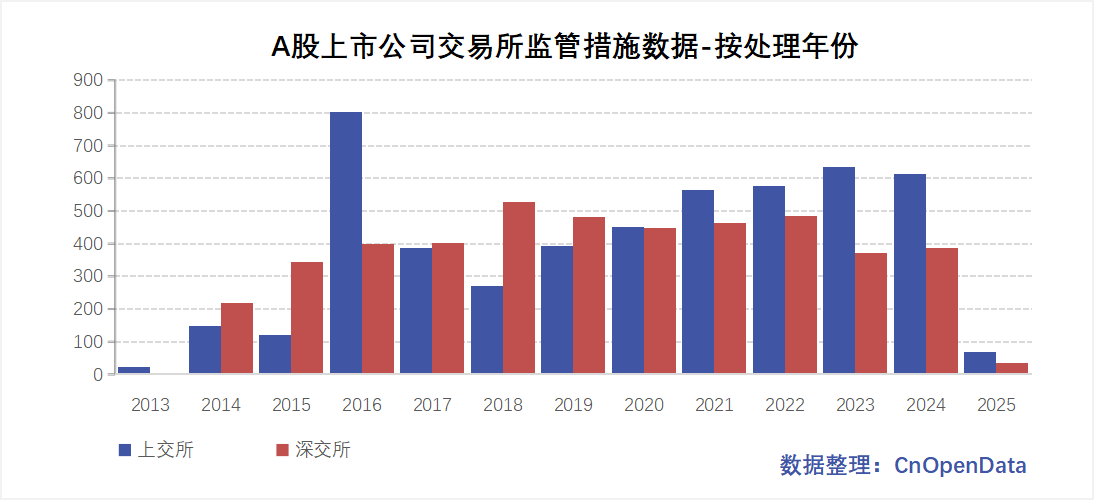

- SSE Regulatory Measures for A-Share Listed Companies: 2013.6.28-2025.3.31

- SZSE Regulatory Measures for A-Share Listed Companies: 2014.4.11-2025.3.31

Data Scale

Field Demonstration

Sample Data

A股上市公司上交所监管措施数据

A股上市公司深交所监管措施数据

Update Frequency

Annual updates