Tax-related professional service providers refer to tax agent firms and other institutions engaged in tax-related professional services, including accounting firms, law firms, bookkeeping agencies, tax agency companies, and financial/tax consulting firms. These institutions provide services such as tax declaration agency, general tax consultation, professional tax advisory, tax planning, tax verification, tax compliance review, and other tax-related agency services. When delivering services, tax-related professional service providers and their personnel must comply with relevant laws and regulations, and are subject to administrative oversight by tax authorities as well as self-disciplinary supervision by relevant industry associations.

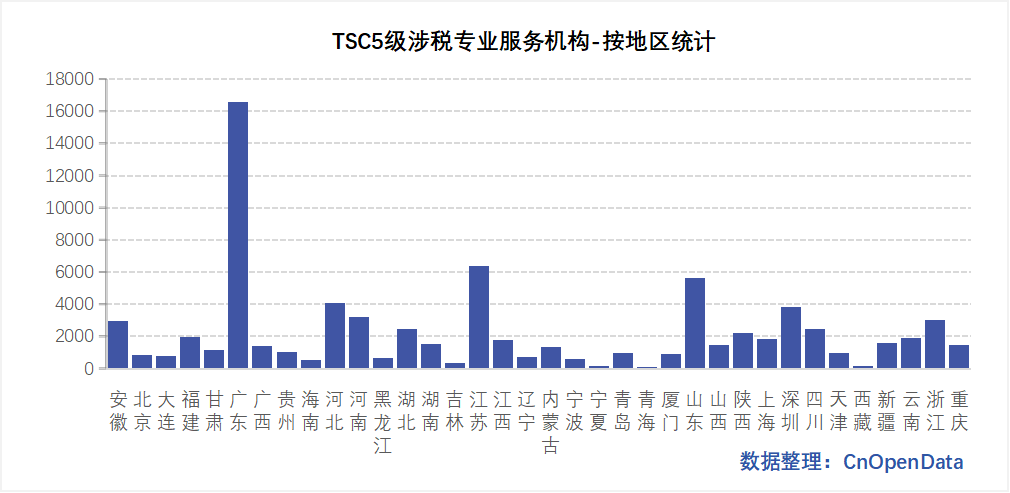

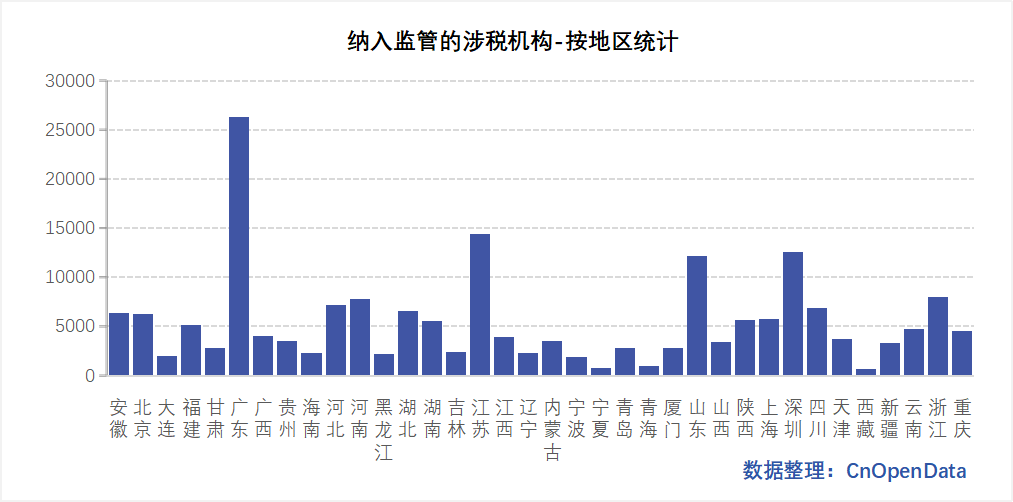

This database integrates authoritative listings of China's tax-related professional service providers, covering three categories: 78,000 TSC5-level institutions (highest credit tier), 190,000 regulated institutions, and over 500 unregistered tax agent firms. Current as of May 2025, the dataset includes core fields such as institution name, Unified Social Credit Code, address, legal representative, credit score points (信用积分), service scale (personnel count, client count), etc. By systematically organizing publicly available information, it comprehensively reflects the ecosystem of the tax service industry, providing data support for researching the marketization of tax services and assisting enterprises in selecting professional service providers.

Data Uniqueness

- Authoritative Classification Covering Industry Subtypes: Distinguishes three lists—TSC5-level (highest credit tier), regulated institutions, and unregistered institutions—revealing industry stratification (e.g., analyzing correlations between TSC5-level institution density and regional tax compliance).

- Service Scale Metrics Indicating Institutional Capacity: Includes fields like personnel count and annual client volume (e.g., "serving 12,000 clients"), enabling analysis of service capacity and market share.

- Standardized Definitions of Key Fields: Terms such as "institution category" (机构类别) and "credit score points" (信用积分) strictly align with the Management Measures for Credit Evaluation of Tax-Related Professional Services, ensuring academic comparability.

Data Application Value

- Academic Research: Analyze correlations between credit scores and regional economic levels (e.g., institutions in the Yangtze River Delta average 15% higher credit scores than the national average), or examine compliance rates of tax agent firms vis-à-vis policy effectiveness.

- Business Decision-Making: Enterprises can compare TSC5-level institution density across cities (e.g., Beijing’s TSC5 institutions account for 32%) and service scale metrics when selecting providers.

- Industry Regulation: Regulators can identify regions with high concentrations of "unregistered institutions" (e.g., one province has 8.7% unregistered entities) for targeted enforcement.

With core advantages in precise classification, credit quantification, and nationwide coverage, this database achieves systematic integration of tax-related professional service provider information. Its stratified tri-category listing, dynamic credit metrics, and nationwide service capacity data provide foundational support for exploring the standardization of China’s tax service market and optimizing corporate financial/tax decision-making.

Time Coverage

As of May 31, 2025 (updatable as needed)

Data Volume

Field Display

Sample Data

TSC5级涉税专业服务机构

纳入监管的涉税机构名单

未经行政登记的税务师事务所名单

Relevant Literature

- CUI Jing, 2019: "Feasibility Analysis of Promoting Tax Service Outsourcing," Taxation Research (税务研究), No. 1.

- Research Group of Tax Service Department, State Taxation Administration; HAN Guorong; ZHANG Songzhou et al., 2022: "Building a Modern Tax Service System from the Perspective of Clarifying Service Positioning," Taxation Research (税务研究), No. 5.

Update Frequency

Annual updates