《华尔街日报》(The Wall Street Journal)是一家以财经报道为特色的综合性报纸,侧重金融、商业领域的报道,在国际上具有广泛影响力,日发行量达200万份。同时出版了亚洲版、欧洲版、网络版,每天的读者大概有2000多万人。《华尔街日报》新闻舆论通过尖利的笔锋净化着商业市场,正是它的舆论监督让商业公司不能为所欲为。

《华尔街日报》报导风格主要如下:

- 以严肃见长。报纸上绝大部分为文字报导,插图新闻很少,相比以活泼著称的《今日美国》形成鲜明对照。《华尔街日报》始终是美国最高端的报纸,其读者群的平均家庭年收入是15万美金。

- 以深度报导见长,对题材的选择也非常谨慎。该报的记者选题的平均周期为六个礼拜。1999年,美国《哥伦比亚新闻评论》评选“走向21世纪的美国21种最佳报纸”,《华尔街日报》名列第三,原因在于“其调查行报导所保持的高品质和挖掘精神”。到2004年底,《华尔街日报》的日均发行量约为180万份。

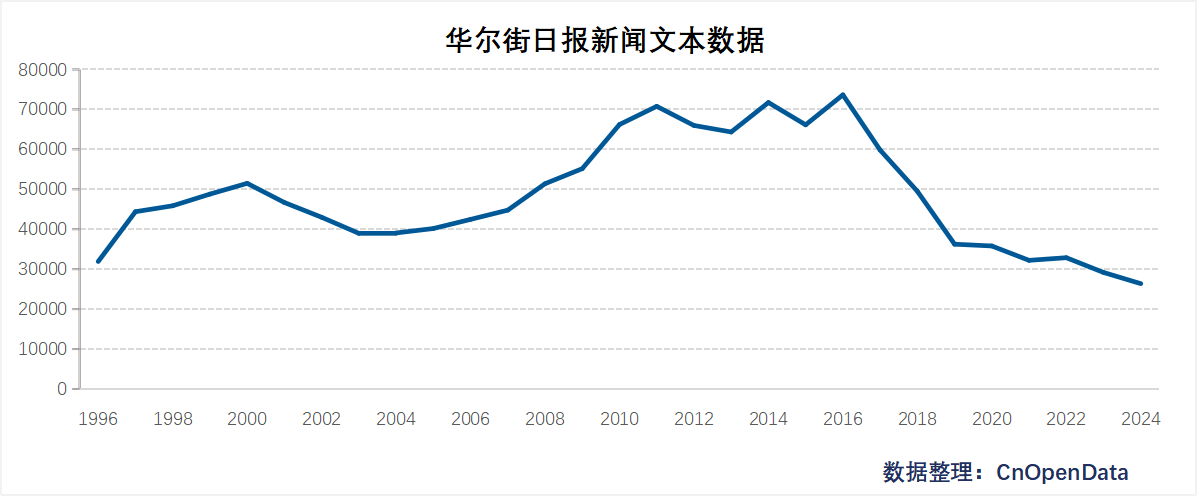

为支持相关研究,CnOpenData推出华尔街日报新闻文本数据,包含标题、副标题、所属板块、类别、作者、发布日期等字段。

时间区间

1997-2024

数据规模

字段展示

样本数据

相关文献

- John A. Helmuth, Ashok J. Robin, John S. Zdanowicz, 1994, "The adjustment of stock prices to Wall Street journal corrections", Review of Financial Economics, Volume 4, Issue 1. +Federico Carlini, Vincenzo Farina, Ivan Gufler, Daniele Previtali, 2024, "Do stress and overstatement in the news affect the stock market? Evidence from COVID-19 news in The Wall Street Journal", International Review of Financial Analysis, Volume 93.

数据更新频率

年度更新