Local government bonds refer to debt instruments issued by local public authorities with fiscal revenue within a country. These bonds are typically utilized for constructing local public facilities such as transportation, communications, housing, education, hospitals, and sewage treatment systems. Generally, repayment of principal and interest is secured by the local government's tax revenue capacity. Two primary issuance models exist: direct issuance by local governments, and central government issuance of national bonds followed by on-lending to local authorities. Under specific circumstances, local government bonds may also be termed "municipal bonds".

China formally initiated local government bond issuance in 2009. Since then, this mechanism has alleviated fiscal constraints on local governments, enabling more flexible fundraising aligned with development plans approved by local People's Congresses to address capital shortages. Furthermore, it has enhanced coordination among the central government, local governments, and local People's Congresses. However, concerns have emerged regarding excessive debt accumulation by some local governments. Given China's vast territory and significant regional development disparities, bond issuance strategies should adapt to temporal and regional conditions to ensure stable development of the local government bond market.

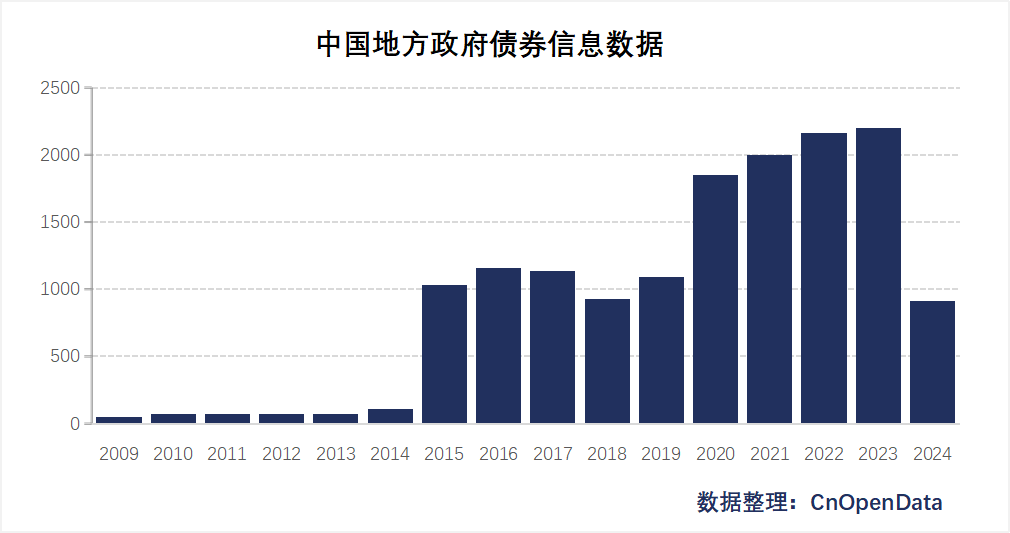

To support related research, CnOpenData has compiled issuance information of Chinese local government bonds since 2009, including fields such as bond name, issuance scale, issuance date, bond type, and interest rate.

Data Scale

Time Range

2009 to July 29, 2024 (updatable upon request)

Field Display

Sample Data

Relevant Literature

- QIU Zhigang, WANG Ziyue, WANG Zhuo, 2022: "Local Government Debt Replacement and New Implicit Debt: Analysis Based on the Scale and Pricing of Urban Investment Bonds", China Industrial Economics No.4.

- ZHANG Qi, YANG Yue, 2023: "Market Recognition and Response to Local Government Budget Disclosure: Evidence from Provincial Government Bond Pricing", Economic Research Journal No.12.

Data Update Frequency

Annual updates