The U.S. stock market represents one of the world's largest and most active capital markets, exerting significant influence on the global economy and financial systems. This impact manifests primarily through the following dimensions:

- Large market capitalization: The U.S. equity market hosts numerous globally influential enterprises;

- High trading volume with superior liquidity: Attracting attention and participation from investors worldwide;

- Well-regulated framework: Featuring relatively comprehensive regulatory and legal systems that ensure orderly market operations and provide favorable investment environments.

Given these characteristics, the U.S. stock market demonstrates strong innovation capabilities and dynamism. Its financial instruments and trading mechanisms evolve rapidly, leading global capital market development. Market globalization further enhances cross-border capital mobility and integration. However, fluctuations in U.S. equities simultaneously correlate with global market sentiment and risk appetite, directly influencing worldwide economic conditions and policy trajectories.

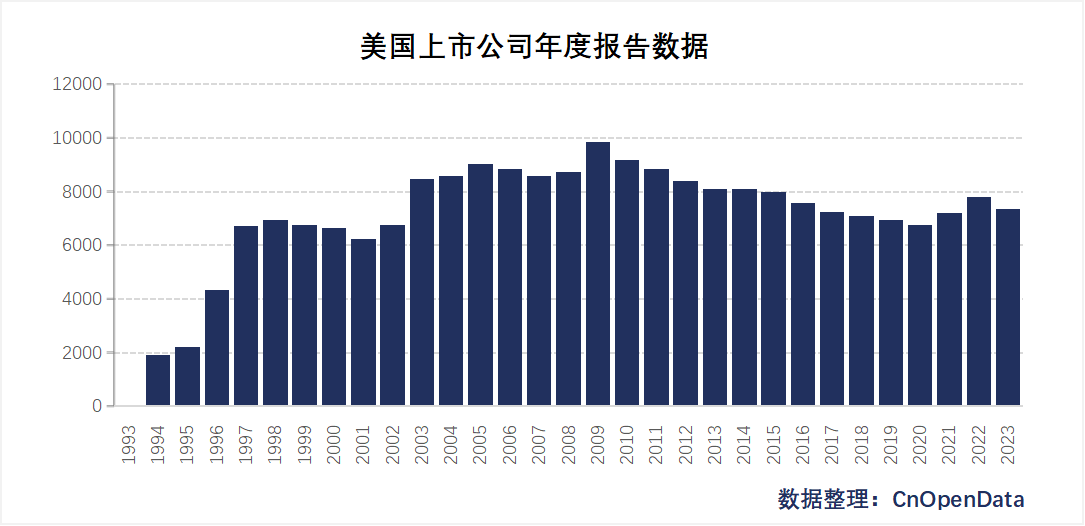

CnOpenData has compiled 209,000 annual reports disclosed by U.S. listed companies spanning nearly 30 years, encompassing both raw textual reports and indexed tabular data, thereby facilitating related academic research.

Time Coverage

1993–2023 (subject to updates as required)

Data Scale

Field Presentation

Sample Data

Relevant Literature

- Theodore E. Christensen, Karson E. Fronk, Joshua A. Lee, Karen K. Nelson, Data visualization in 10-K filings, Journal of Accounting and Economics, Volume 77, Issues 2–3, 2024, 101631, ISSN 0165-4101, https://doi.org/10.1016/j.jacceco.2023.101631.

- Cyrus Aghamolla, Kevin Smith, Strategic complexity in disclosure, Journal of Accounting and Economics, Volume 76, Issues 2–3, 2023, 101635, ISSN 0165-4101, https://doi.org/10.1016/j.jacceco.2023.101635.

- Robert Hills, Matthew Kubic, William J. Mayew, State sponsors of terrorism disclosure and SEC financial reporting oversight, Journal of Accounting and Economics, Volume 72, Issue 1, 2021, 101407, ISSN 0165-4101, https://doi.org/10.1016/j.jacceco.2021.101407

Data Update Frequency

Annual updates